ecommerce

Enrich eCommerce Risk Decisions with Behavioral Intelligence

Enrich eCommerce Risk Decisions with Behavioral Intelligence

Protect new touchpoints and customer journeys from within the Darwinium portal. Tailor customer experiences based on trust and risk.

Book a Demo

Protect Against the Top Threats in eCommerce

Account Takeovers (ATOs)

Detect behaviors that indicate account compromise, such as credential stuffing, device anomalies, or access from unusual geographies.

Promo & Loyalty Abuse

Block fraudsters creating multiple accounts to exploit discount codes, loyalty points, or first-time buyer incentives.

Payment & Checkout Fraud

Spot card testing, BIN attacks, and fraudsters using stolen card data, using behavioral analytics and journey context.

Refund & Return Abuse

Identify suspicious post-purchase behavior and curb excessive or fraudulent refund claims.

Why eCommerce Businesses Choose Darwinium

Understand user behavior from browsing, through login, basket creation, and checkout. Enrich downstream risk decisions with upstream context to reduce manual reviews and streamline user experience.

Case Study: Global eCommerce Technology Company

“The Darwinium team showcased a profound understanding of our requirements, offering innovative solutions to help us reach our objectives. The platform’s flexibility is particularly impressive, allowing us to meet the unique needs of our business and clients.”

Investigations

Give your fraud and risk teams the tools they need to deep-dive into suspicious activity across the shopper journey. Darwinium’s investigation tools are designed for business users, analysts, and data scientists to quickly uncover fraudulent behavior, like promo abuse, account takeovers, or bot-driven checkout attacks, with clarity and precision.

Build Brand Loyalty and Customer Trust

Staying ahead of the competition relies on building digital interactions that your customers love, to keep them coming back. Darwinium delivers a safe, secure and personalized shopping experience while protecting the entire customer journey against account takeover and payment fraud.

eCommerce and Darwinium Edge

Understand true user intent, with full visibility of fraud and risk intelligence across security, fraud and customer experience teams.

The Darwinium Difference

Fraud and abuse targeting customer accounts is more complex, and fraudsters are more successful. Fraud-as-a-service providers use AI to scale and enhance the efficacy of attacks.

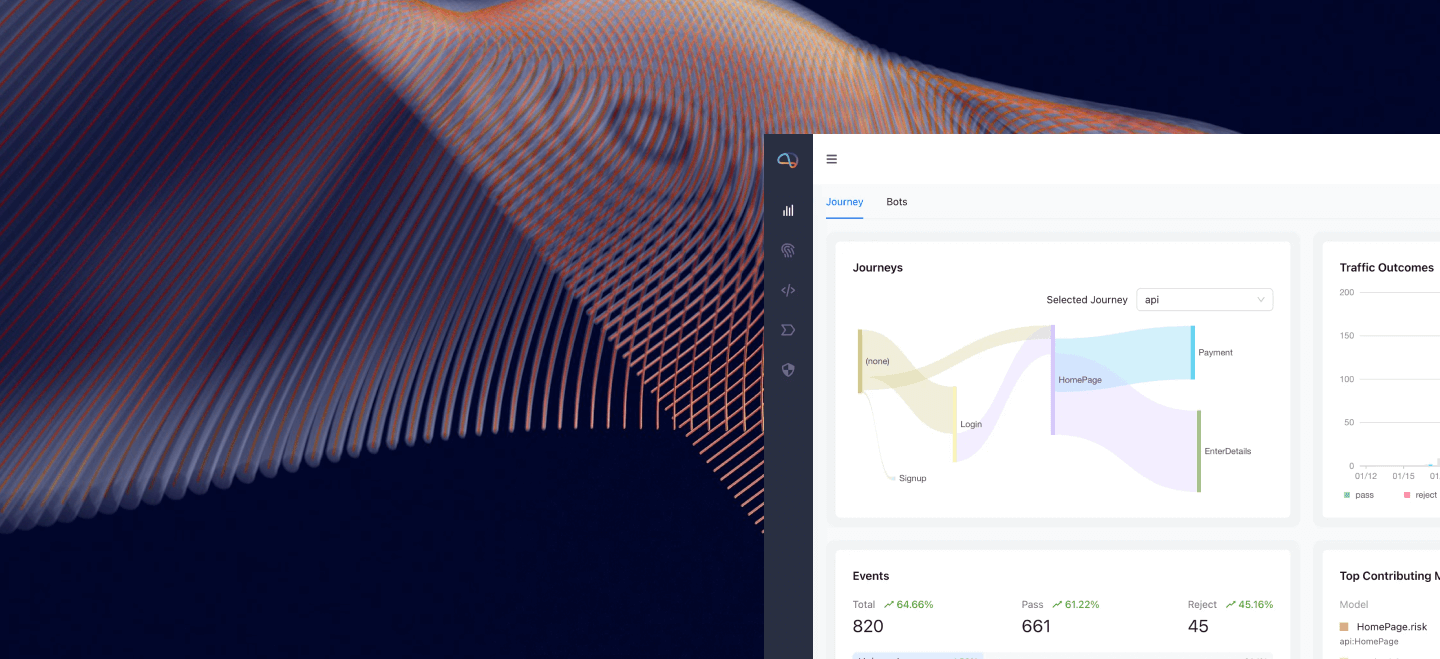

Integrate Upstream Behavior Into Downstream Decisioning

Darwinium collates user behavioral analytics and fraud intelligence across every interaction in the customer journey. This means that interactions at browsing or login can be used to better inform the risk of a payment at checkout. Darwinium labels allow fraud teams to consolidate the tasks of confirmed outcome tagging and lists, making it easier to action on confirmed intelligence.

Reduce the Burden of Manual Reviews

Darwinium has a real-time decision engine that incorporates an extensible in-built feature platform, targeted rule engine, and model execution environment. Analysts and data scientists can create their own logic to manage the routing of trusted and fraudulent cases, focusing their efforts on only those cases that genuinely need reviewing.

Access Fraud Analytics, Everywhere

Consolidate all data needed for real-time assessment: layer native profiling of devices, behavioral analytics and behavioral biometrics, with third-party intelligence available via Darwinium Marketplace partners. Offline data - such as in-store events or returns data - can be ingested via the Darwinium API. These interactions can then be incorporated into the decision engine, and made available for analysis.

Whitepaper

Continuous Protection for the Digital Customer Journey

Discover how Darwinium delivers end-to-end fraud prevention without disrupting the customer experience. Download the white paper to see how we’re redefining risk management for digital businesses.